What is happening in the hyperconverged market? Just last week, HPE’s results claimed growth in its high-margin Value Compute portfolio of 20% driven by strength in high-performance compute and hyper-converged. The HCI market jumped to nearly $1.5bn in sales during the second quarter of 2018, up 78% year over year, according to data from IDC. Most predictions have it growing between 20% and 50% this year.

But all may not be well at the core, with the Nutanix CEO’s recent blog post accusing VMWare of being a bully. Competition among VMware’s 24,000 partners globally is fierce, and the skills demanded of them are high, which adds to costs. A few weeks ago, US-based hyperconverged vendor Maxta simply closed its doors, having burned through millions of dollars in its ten year life. Others have been sold - Cisco acquiring hyper-converged software developer Springpath for $320m in 2017 and bought 5-year old Skyport Systems last year. HPE also bought hyperconverged network vendor Plexxi, for its software-defined compute and storage capabilities.

It looks like a shake-out as customers, while liking the technology, and knowing that software-defined everything is the future, keep buying, but realise that that price also contains considerable running costs, both in management and hypervisor.

Talking to Scale Computing’s CEO Jeff Ready, whose business in hyperscale – all sold through channels – hit new heights last year and who plans on doubling his partner base again this year, the issue is how the VMware-based products are all similar and hard to manage. And then there is the cost of VMware for many of these systems. “They all need a lot of admin work – IT managers will have a VMware screen open most of the day to monitor the systems.”

Perhaps it is all in the definition: there is hyperconvergence as storage for a VMware environment, which is what most people do, then there is the further integration beyond that, which is what Scale Computing does, he claims. “I have always considered VMware to be my main competitor.”Where you are seeing firms struggle is with being “me-too” forms of storage for VMware. If they don’t get the critical mass or right partnerships in place, there is not a lot of difference between them and why would customers take a chance on smaller companies? There is still room for someone coming in and taking it in a new direction.” For Scale it has certainly been the automation aspect that has driven its growth in the last year.

It is clear that Scale itself is finding growth in specific markets such as retail, and at the edge more than the data centre, and that a lower-management message is finding resonance among the mid-sized and SMB customers.

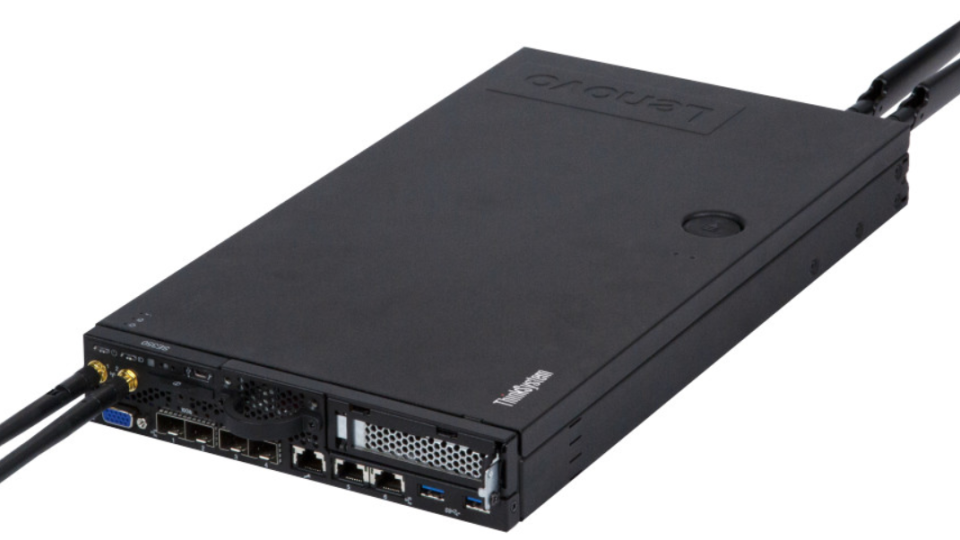

It also means that servers don’t look like servers anymore – new form factors are working at the edge. At this week’s MWC Barcelona, Lenovo will unveil the ThinkSystem SE350 (pictured), an edge server that is just slightly larger than a ThinkPad. This purpose-built server will come to market this summer and is half the width and significantly shorter than a traditional server, making it ideal for deployment in tight spaces. It can be mounted on a wall, stacked on a shelf or mounted in a rack. And Lenovo is a key partner for Scale; Lenovo’s Retail Store Infrastructure solution in partnership with Scale Computing, means retail customers can mini data centers that offer enterprise-class IT infrastructure at the edge of their networks. Ahold Delhaize, an international food retail group headquartered in Zaandam, Netherlands, operates supermarkets and e-commerce businesses across 6,700+ stores in 11 countries, says it has reduced time spent deploying and managing edge IT infrastructure using this solution.

“We are seeing HCI evolving into what it was all along – it is a technology not a product,” he says. There are different versions – but it is effectively virtualized software defined storage that replaces a SAN. It can be used in traditional storage or incorporated into an all in one as we do, or roll it into video surveillance like Pivot 3 do. What we have done at Scale is the hyperconverged bit and then the orchestration. And what we have done is make the system self-healing and while this has nothing to do with hyperconvergence. This has given us success in markets such as SMB with limited resources.”

“What has happened for us over the last year or so is ‘edge computing’ – there are lots of definitions but it simply puts mission critical infrastructure outside the data centre. So this Scale automation tech is allowing us to shine in this space – we can go into places where there are no IT people, and the systems needs to be self-managing. This has emerged as our sweet spot and we are going after it aggressively. Global retailers don’t think about hyperconverged systems they just want a system that runs in the store and looks after itself.”

Lenovo is ahead of the curve in attacking the edge environments where a lot of things are done differently. “You can push an incredible amount of work through these tiny units. We see lots of demand for this, and it will only rise, with the growth of IoT and edge date collection,” he says. And automation is the key – the enterprises are not going to add more people – the systems have to manage themselves.

“On IoT – I have been an IoT sceptic, but I am now seeing what I think is real IoT – a lot is coming from the infrastructure that is used to be operational technology – sensors and things. It is not that the IoT didn’t exist before but there is a new convergence of operational technology with what used to be proprietary into a standard form. Particularly using the new high definition cameras and the new AI chips, a lot more processing just has to happen at the edge - the cloud just can’t handle that sort of data speeds," he concludes.

So ironically, the edge seems to be where the hyperconverged technology is finding a new home.