The notable feature of last year was the divergence between public cloud for the mass markets – AWS, Google, Microsoft etc, and the still large scale, but more specialised providers.

The notable feature of last year was the divergence between public cloud for the mass markets – AWS, Google, Microsoft etc, and the still large scale, but more specialised providers.

The notable feature of last year was the divergence between public cloud for the mass markets – AWS, Google, Microsoft etc, and the still large scale, but more specialised providers. While prices fell, as expected, the gap between the lowest pricing – usually Amazon, and the others did not close significantly. This shows that there is another side the managed services apart from price, and one that users will pay for when they see value.

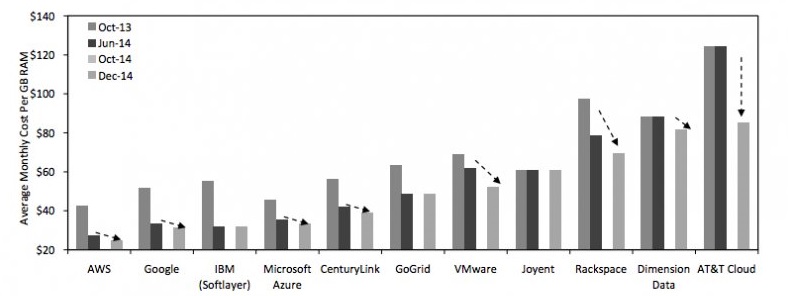

The chart by RBC Capital shows the average monthly cost per Gb of RAM excluding support costs, and shows the steady decline in the US, which indicates likely global positions. AWS's revenue growth slowed dramatically toward the end of last year — annualized growth was around 60% in 2013, versus less than 40% now — but RBC thinks growth will stabilise in 2015 as the price wars slow down.

But what about the value end of the business which is more likely to involve smaller suppliers, MSPs and other channels? Researcher TBR says companies in this business may be best placed to take advantage of the trend towards smaller and short projects The pace of change in the IT environment has increased dramatically, with the main driver the development of cloud applications, it argues. In addition to the flexibility to scale up or scale down as the business changes, cloud provides organisations the ability to adopt only the parts of the software they need. Rather than having to do a massive, several-year ERP or CRM deployment, a customer can isolate business and focus on deploying software that addresses those problems. As a result, TBR believes the demand for systems integration project-based services will continue to shift from multiyear projects focused on deploying large enterprise platforms to shorter more tactical projects that aim to add features onto back-end systems incrementally to drive additional revenue.

Gartner says the model is getting both more complex yet potentially easier to manage: “The convergence of cloud and mobile computing will continue to promote the growth of centrally coordinated applications that can be delivered to any device. Cloud is the new style of elastically scalable, self-service computing, and both internal applications and external applications will be built on this new style," it says. "While network and bandwidth costs may continue to favour apps that use the intelligence and storage of the client device effectively, coordination and management will be based in the cloud."

In the near term, the focus for cloud/client will be on synchronising content and application state across multiple devices and addressing application portability across devices. Over time, applications will evolve to support simultaneous use of multiple devices. The second-screen phenomenon today focuses on coordinating television viewing with use of a mobile device. In the future, games and enterprise applications alike will use multiple screens and exploit wearables and other devices to deliver an enhanced experience.

The companies best positioned to take advantage of this trend are the MSPs and suppliers that have deep relationships with a wide range of software partners and are familiar with the demands of the low end of the large enterprise market and the high end of the midmarket, it says.

IDC's FutureScape for Cloud report predicts that by 2017, IT buyers will actively channel 20% of their IT budgets through industry clouds to enable flexible collaboration, information sharing, and commerce. IDC is also predicting that by 2016, there will be an 11% shift of IT budget away from traditional in-house IT delivery, towards various versions of cloud as a new delivery model. By 2017, 35% of new applications will use cloud-enabled continuous delivery and DevOps lifecycles for faster roll-out of new features and business innovation, it says.

It is not just the managed services providers that are affected by this market change. These drivers are affecting not only the traditional on-premises solutions, but also the traditional outsourcing market who could provide competition in new ways. Companies are no longer as willing to enter into seven- to 10-year mega outsourcing deals. They are looking for shorter, more flexible options for IT infrastructure, and the IaaS and PaaS markets provide these options.

Outsourcing companies that can provide IaaS and PaaS services to their customers will be best-positioned to benefit from this trend. They have a large customer base that is looking to migrate and views the company, depending on their relationship, as a trusted service provider with the industry-relevant experience to help clients through these transitions seamlessly.

In terms of technologies, Gartner predicts 4.9 billion IoT-enabled devices in use in 2015, which would represent a 30% year-over-year increase. While not yet mainstream and engaging MSPs, the IoT could create security issues, and Experian Data Breach Resolution recently pointed out that hackers might even start launching IoT cyber attacks in 2015. MSPs that offer secure, innovative services to help customers embrace the IoT, however, could reap the rewards of this technology as the wave of news stories about cyber-attacks and security breaches is set to rise further.

Another effect picked up by many commentators is the skills shortage. All of the major services providers face challenges, as the global supply of talent required is not sufficient to meet demand. This will increase the costs of acquiring and retaining this talent, reducing corporate profitability. Furthermore, the supply is so short, that even firms that can acquire the talent are having problems retaining that talent, as the best employees are being recruited by competitors.

IT Europa and Angel Business Communications will jointly be staging the fifth annual UK Managed Services & Hosting Summit on 17 September 2015. The event will bring leading hardware and software vendors, hosting providers, telecommunications companies, mobile operators and web services providers involved in managed services and hosting together with Managed Service Providers (MSPs) and resellers, integrators and service providers migrating to, or developing their own managed services portfolio and sales of hosted solutions.

The Managed Services and Hosting Summit 2015 will take place at 155 Bishopsgate, London, on 17 September 2015. MSPs, resellers and integrators wishing to attend the convention and vendors, distributors or service providers interested in sponsorship opportunities can find further information at:www.mshsummit.com